Corporate Access

We nurture long-term relationships

Asia Securities Research boasts the broadest company coverage in the industry and was ranked among the top Stockbroking Research firms in the country by the CFA Sri Lanka Capital Market Awards over the last seven years. Our macroeconomic research is closely followed by domestic and international clients. The firm offers superior C-level corporate access, hosts Sri Lanka’s only consistent range of investor events, including the Wealth Insights and InsideTrack Series, as well as the flagship Annual Sri Lanka Investment Conference.

Asia Securities' clients can access our full suite of research publications via our research portal.

Login to the research portalTo become a client of Asia Securities, reach out via [email protected].

We nurture long-term relationships

Our award-winning analyst team covers over 50 stocks and pioneers research across 14 sectors.

We offer the only regular investor event series

Corporate decisions are powered by robust insights.

Published at the beginning of the year, Asia Securities’ Equity strategy report discusses the market trends and expectations for the year ahead, including detailed views on sectors and stocks for the forthcoming year.

Asia Securities’ monthly economic publication rounds up the key macroeconomic events during the month, keeping investors up to date with all developments in the macro front. The report also touches on all key economic indicators and Asia Securities’ forecasts and views.

A comprehensive breakdown and analysis of a John Keells Holdings and its segments, with multiple valuation methodologies to back our thesis.

Best Stockbroking Research Team (Gold)

Best Sector Research Report (Gold)

Best Stockbroking Research Team (Gold)

Best Stockbroking Research Team (Silver)

Best Stockbroking Research Team (Silver)

Best Stockbroking Research Team (Gold)

Best Stockbroking Research Team (Gold)

Best Equity Research Report (Gold)

-(1920-x-1280-px).png)

Asia Securities sheds light on opportunities for investors from CSE’s launch of Stock Borrowing & Lending and Short Selling

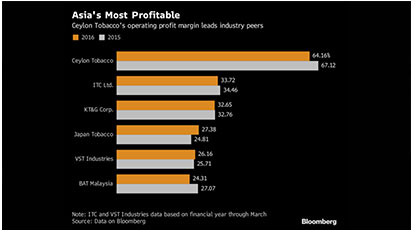

• Ceylon Tobacco says tax increases to narrow profit margins • Smokers seen switching to leaf-rolled products like beedis

Sweeps research awards at 5th annual CFA Sri Lanka Capital Market Awards

Sri Lankan stocks have rebounded strongly in 2017, reversing a two-year trend where it underperformed several other asset classes. The All Share Price Index (ASPI) of the Colombo Stock Exchange has returned 7.4% in the first four months of this year, closing at 6,610 while the more liquid S&P20 index has returned 10.1%.

Dec 8 Sri Lankan shares rose on Thursday as a stake buy in Commercial Credit and Finance Plc by a unit of Thailand’s Group Lease Plc lifted the mood while foreign investors bought domestic stocks and turned net buyers so far in the year

ECONOMYNEXT – Thailand’s Group Lease Holdings bought a 30% stake in Sri Lanka’s Commercial Credit and Finance at Rs111 a share in a Rs10.6 billion deal, a stock exchange filing said.

The Sri Lankan government is set to reform its foreign exchange control legislation early next year in a bid to increase foreign direct investment (FDI) into the country and spur export growth.

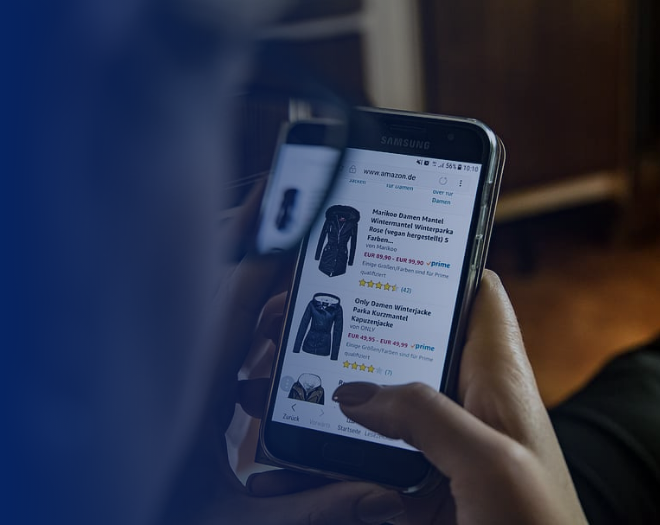

ECONOMYNEXT – Sri Lanka’s consumer and retail sector has strong growth prospects given increasing disposable incomes and changing lifestyles, according to a new study by stock brokerage Asia Securities.

Brandix Lanka Limited CEO Ashroff Omar affirmed that the Sri Lankan apparel sector has room to grow further despite the country reaching the middle-income status.

The well-attended Sri Lanka Summit in Singapore organised by the Finance Asia recently had a very useful session on ‘Equity Investments in Sri Lanka’.

A new study out today outlines the changing landscape of the growing construction sector. The study by Asia Securities (ASEC) suggests that the next 10 years will see a shift in growth from infrastructure to housing.

Foreign debt raised by the private sector firms during the last few years are now a cause for concern as servicing such debt has become a challenge for the borrowers with the rising interest rates in the United States and the depreciating Lankan rupee, a Colombo-based stockbroking house said.

Sep 04,2015 (LBO) – Sri Lanka’s Asia Securities says it is bullish on the Sri Lanka telecommunication sector even though a recently released report by Standard & Poor’s ratings agency sees telecom regulatory risk in Sri Lanka as high.

June 19, 2015 (LBO) – Sri Lanka Asia Securities says that small and medium enterprises (SME) will drive banking loan growth going forward.

Sri Lanka’s banks are set to hit a growth stage, having withstood the global credit crunch, on strong asset consolidation and diversification, an analytical report released by Asia Securities showed yesterday.

After the end of a long-running civil war and the beginning of a fresh government, Sri Lanka’s market offers both opportunities and pitfalls for investors.

.png)

Research

New

Research

New

Research

New

Research

.png)

Research

Research

Research

Research

Research

Research

Research

Research

Research

Research

Please fill in the form below and one of our advisors will be in touch with you within two business days